Operational Internal Controls

Operational controls govern the accurate and consistent execution of customs- and excise-related activities in the terminal's day-to-day operations. These include:

-

Accurate registration of product movements in the Terminal Management System (TMS), capturing relevant data such as product classification, quantity, and regulatory status (e.g. customs warehoused, excise suspended).

-

Automated interfacing between TMS and the Customs Management System (CMS), enabling timely and correct generation of customs declarations, EMCS messages, and related compliance records.

-

Segregation of duties between planning, execution, and reporting roles to minimise operational and compliance risks.

-

Routine checks and reconciliations, exception reporting, and automated monitoring supported by the BzCtrl compliance platform to identify and address deviations.

These controls help ensure the operational integrity and traceability of customs- and excise-relevant processes.

The following section provides an overview of the key controls that form part of the Customs and Excise Compliance Framework. These controls are designed to manage legal obligations, mitigate compliance risks, and ensure the integrity of customs- and excise-related processes across operational, general compliance, and license-specific areas.

It is important to note that the design, scope, and frequency of these controls are not static. They are subject to change based on regulatory developments, business needs, operational changes, and findings from audits or monitoring activities. As such, the control framework is adaptive by nature and reviewed on a regular basis to ensure that it remains effective, proportionate to risk, and aligned with the evolving requirements of the business and the applicable legal landscape.

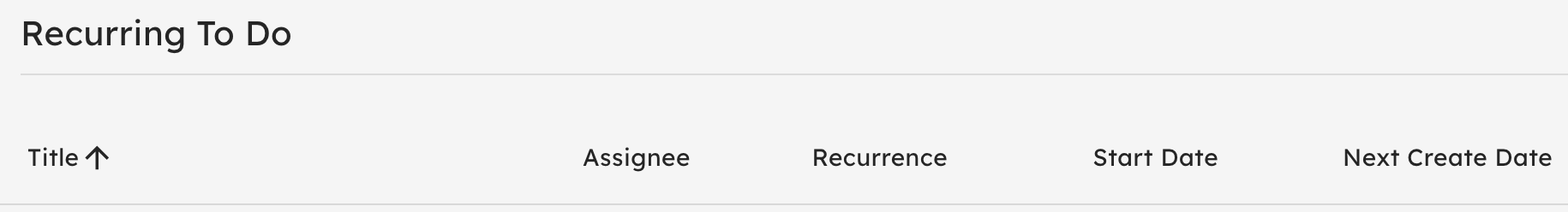

Control: Monitoring and Clearance of Outgoing Customs Documents

In accordance with applicable customs and excise regulations, the consignor bears fiscal responsibility for ensuring the timely and accurate clearance of outgoing customs documents, including but not limited to transit (e.g. T1), electronic Administrative Documents (e-ADs), and export declarations.

The purpose of this control is to monitor the clearance status of such documents, identify any delays or irregularities, and take timely corrective action where needed. This helps to ensure that all obligations related to the closure of the customs procedure are met and that the organisation remains protected against potential financial liabilities, such as duties, penalties, or guarantees being called upon due to unclosed movements.

By safeguarding the proper clearance of outgoing customs flows, this control contributes to the organisation's overall customs compliance, risk mitigation, and audit readiness.

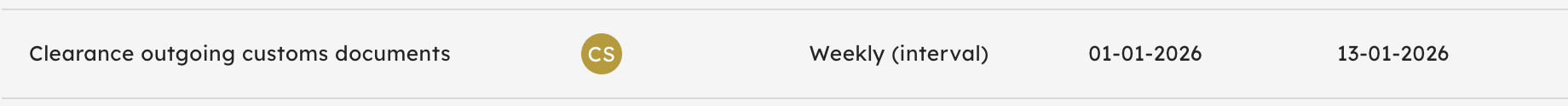

Control: Incident Review and Trend Analysis

The objective of this control is to periodically review recorded incidents within the customs and excise compliance domain in order to identify recurring patterns, root causes, or structural weaknesses. This review is conducted both at a macro level to detect trends or systemic issues that may require corrective or preventive measures and at a micro level, where individual incidents may warrant more detailed investigation.

By systematically analysing incident data, this control supports continuous improvement, risk mitigation, and the strengthening of internal controls, ensuring that appropriate follow-up actions are taken and that lessons learned are embedded in the organisation's compliance practices.

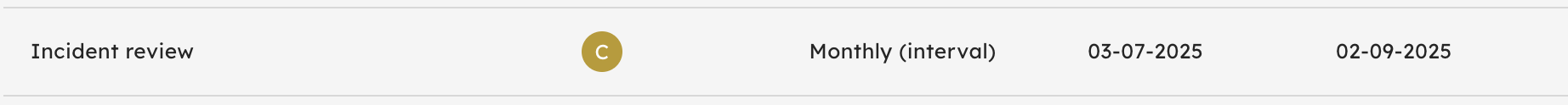

Control: Monthly Stock Reconciliation

This control ensures that a monthly reconciliation of stock records is performed to verify that all goods held in the terminal are properly accounted for in the administrative systems. The objective is to confirm the accuracy, completeness, and consistency of physical stock levels against system-based inventory records.

From a compliance perspective, customs and excise authorities require businesses operating under suspension or bonded regimes to maintain adequate and reliable stock records as part of their record-keeping obligations. Regular reconciliation supports this requirement and helps detect discrepancies, losses, or administrative errors in a timely manner.

This control is fundamental to maintaining the integrity of inventory data, safeguarding authorisation conditions, and ensuring ongoing compliance with customs and excise legislation.

No Comments