Scope

Scope of Application Across the Group

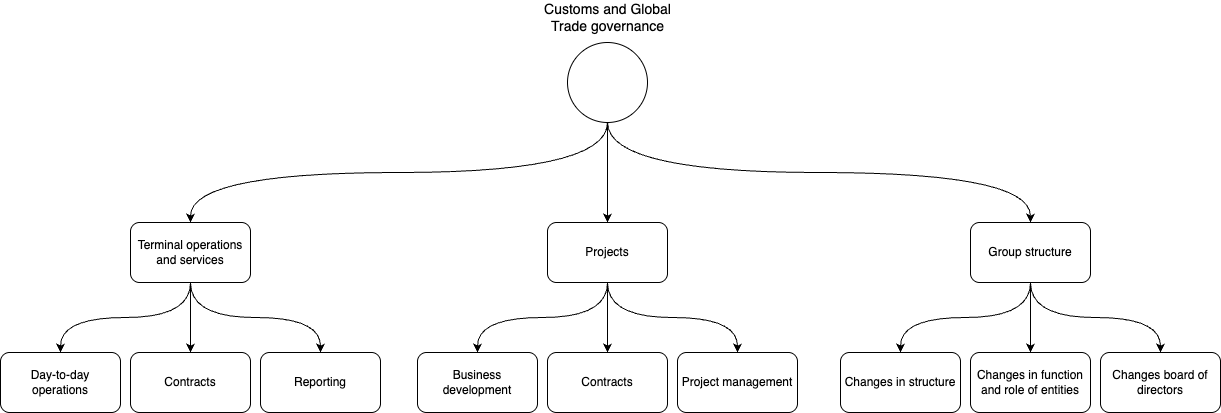

From a group-level perspective, the Customs and Global Trade Control Framework applies broadly across various components of the organisation to ensure integrated, consistent, and compliant customs and trade management. The scope includes, but is not limited to, the following key areas:

-

Terminal Operations and Services

This includes the day-to-day operations at terminals where energy products are stored, handled, processed, or transshipped. Activities in scope cover:-

Operational customs and excise procedures (e.g., import/export declarations, EMCS movements, warehousing).

-

Compliance with licenses, permits, and authorisations related to customs and excise.

-

Accurate and timely reporting to authorities, including inventory reconciliation, duty management, and bonded stock oversight.

-

Contractual arrangements with customers and third parties, particularly those that may impact customs responsibilities or liability (e.g., Incoterms, tax representatives, agents).

-

-

Projects and Business Development

Customs and trade compliance considerations are also integrated into projects and strategic initiatives, including:-

Business development activities involving new flows, new products, or the expansion of services across borders.

-

Contract negotiation and structuring for new ventures, ensuring customs roles and obligations are clearly defined.

-

Project execution and management, including the establishment of new facilities, terminals, or cross-border infrastructure that may require new customs authorisations or impact trade compliance.

-

-

Group Structure and Legal Entity Governance

Changes in group structure or governance can have direct implications for customs registrations, licensing, and responsibility allocation. In scope are:-

Establishment, relocation, or dissolution of legal entities with customs or excise functions.

-

Functional changes in legal entities that affect their role in the supply chain.

-

Changes in board composition or senior management roles that trigger notifications or require updates to customs authorisations (e.g., AEO, excise licences).

-

Intragroup restructurings, mergers, acquisitions, or divestments that may alter supply chains or require customs reauthorisations.

-

Integrated Approach

To manage these diverse areas effectively, the framework promotes early involvement of the Customs and Global Trade function in operational decisions, contract negotiations, and structural changes. This ensures that customs and trade compliance is embedded in the business, risk is proactively managed, and regulatory obligations are met across all levels of the Group.

No Comments