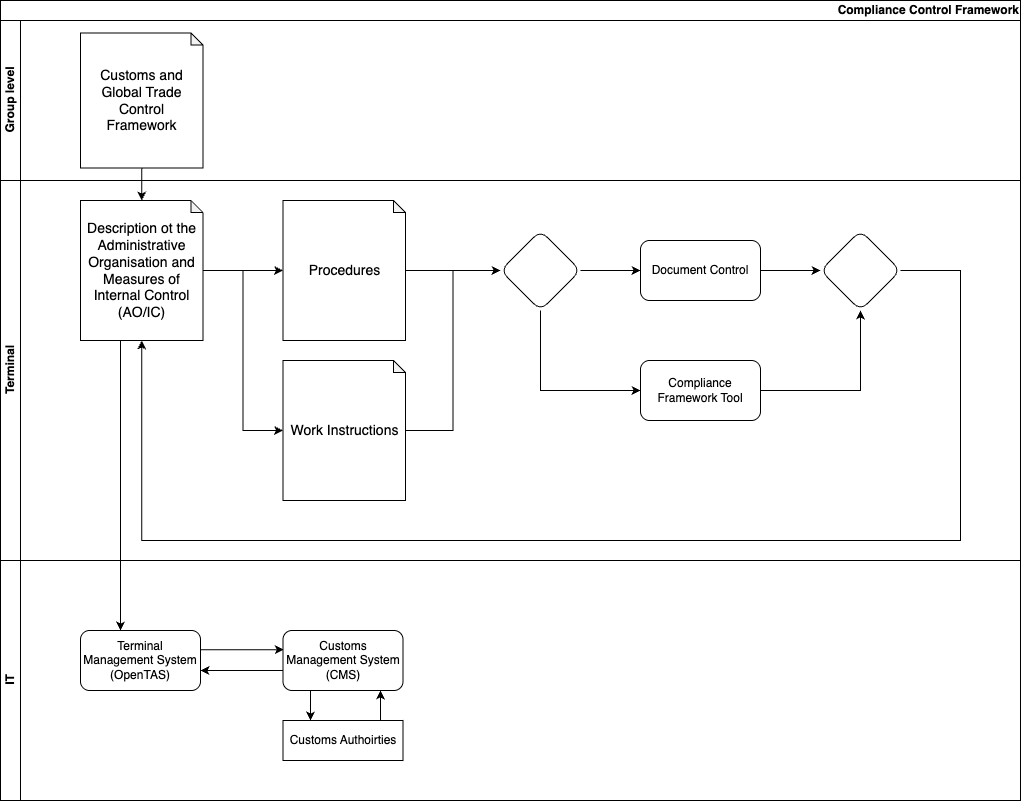

Terminal-Level Compliance Control Framework

At terminal level, the Customs and Global Trade compliance control framework is structured around a clearly defined Administrative Organisation and Internal Control (AO/IC). This umbrella document outlines how the terminal is organised from a governance, staffing, and internal control perspective, ensuring that the necessary competencies, roles, and responsibilities are in place to meet all customs and excise compliance obligations.

The AO/IC document serves as a foundational requirement for obtaining and maintaining customs and excise licenses. It describes the organisational setup and control measures across key functions, including:

-

The Customer Services and Customs team, responsible for day-to-day customs declarations, EMCS processing, and direct liaison with customs and excise authorities.

-

Operations, which ensures the correct handling, storage, and administration of goods under customs or excise control.

-

The Management Team, accountable for ensuring the overall integrity of the terminal's control environment, adequate resourcing, and escalation of compliance issues when needed.

-

The Compliance Officer, who plays a central role in maintaining the effectiveness of the compliance framework. This role involves overseeing adherence to customs and excise obligations, coordinating the AO/IC review and update process, monitoring internal controls, conducting compliance reviews, and acting as a key point of contact for both internal stakeholders and external regulatory authorities.

To operationalise the AO/IC, the terminal maintains a comprehensive set of detailed procedures and work instructions, governing all relevant customs and excise processes. These documents are managed through a document control system that ensures they are current, version-controlled, and accessible to authorised personnel. This ensures consistency, clarity, and traceability in how procedures are executed and maintained.

-

Centralised documentation and process flow mapping

-

Execution and monitoring of automated internal controls

-

Logging of findings, learnings, and follow-up actions

-

Collaboration tools for effective coordination among teams

-

Dashboards and reporting features to support compliance oversight

Through the integration of a robust AO/IC framework, formalised procedures, strong compliance leadership, and a digital governance platform, the terminal ensures that customs and excise requirements are continuously met, risks are effectively managed, and regulatory licenses are maintained.

No Comments